Physicians who are also business owners have two jobs: treating patients and running their business. Hiring and keeping employees is one of the job descriptions of the latter. It is no surprise that choosing and maintaining employee benefits is not at the top of an exciting to-do list. Even if hospital systems are not your direct competition, they are often competing for the same employee pool as you, and hospitals generally have robust benefits. One of the most valuable and attractive benefits is the retirement plan.

What is a retirement plan?

Retirement plans can be distilled into two primary sections: Defined Contribution Plans and Defined Benefit Plans. These are jargon terms, but they are helpfully descriptive. If you want to focus on funding a plan and the end result (or the value of the retirement plan) is variable based on funding and performance of the investments, then a defined contribution plan is the way to go. If you want the end result of the retirement plan to consist of a specific dollar amount or a secured passive income stream, and you are OK with a variable contribution schedule, then a defined benefit plan is likely a good fit. Let us look at how each of these plans operate and review some examples.

Defined contribution plans

When you think of a retirement plan, you generally think of a defined contribution plan, such as a 401(k) or a 403(b). A defined contribution retirement plan creates accounts for employees and employers to fund to prepare for retirement. The most common retirement plan structure allows for a matching system, which means the employer funds the retirement account for the employee only if the employee funds it first. This type of structure can reduce costs in the plan as some employees may choose not to fund the retirement plan, and some retirement plans may require a minimum length of service before the employee is eligible to fund a retirement plan, limiting the cost of high employee turnover. Additionally, vesting schedules can be added, which determine how long an employee must work for an employer before the matching contributions become theirs.

The 401(k) and 403(b)

Some of the most common defined contribution retirement plans are the 401(k) and the 403(b). These plans have annually determined limits for employee deferral contributions ($23,500 for 2025) and annual limitations for total contributions ($69,000 for 2025). The total contribution limitations include employee deferred (or Roth) contributions, employer matching or profit-sharing contributions, and after-tax employee contributions. The primary difference between the 401(k) and the 403(b) is the type of company for which the retirement plan is used. 401(k)s are available to for-profit companies, while 403(b)s are available to nonprofit and governmental entities. In essence, 401(k) and 403(b) plans are incredibly flexible. They can incorporate traditional and Roth contributions, offer loans, customize vesting schedules, and design specific employer match structures. They can be as simple or complex as needed. These plans are available for large employers as well as solo business owners.

IRAs

Defined contribution retirement plans also include some employer-sponsored IRAs, such as SIMPLE IRAs and SEP IRAs. An IRA is an Individual Retirement Account (or “Arrangement”). Unlike a 401(k) or a 403(b), an IRA is an account that is individually owned, so any funds (including employer contributions and matching) belong to the employee immediately.

SIMPLE IRAs

SIMPLE (Savings Incentive Match Plan for Employees) IRAs are useful for employers with a smaller headcount of employees and do not mind manually funding the accounts. SIMPLE IRAs are generally inexpensive to manage, but they do need a person to manage them. SIMPLE IRAs are a great fit for small companies on a benefits budget. SIMPLE IRAs have lower contribution limits ($16,500 for 2025), and streamlined matching options (generally two to three percent).

SEP IRAs

SEP (Simplified Employee Pension) IRAs are also very easy and inexpensive to manage. SEP IRAs are funded by employers only, meaning an employee cannot make their own contributions. An employer can fund up to twenty-five percent of her salary into a SEP IRA, up to $69,000 annually. If she funds her SEP IRA at twenty-five percent, then she needs to fund every employee’s account at the same percentage of their salaries. SEP IRAs are most commonly used for business owners or contractors without employees.

Choices, choices, choices

Defined contribution retirement plans have many different plans to choose from. This abundance of choice allows the business owner to fit the retirement plan to their business. Conversely, defined benefit retirement plans do not have many choices of plans. Instead, there are essentially two types: defined benefit retirement plans and cash balance plans.

Defined benefit plans

For those businesses (even business owners without employees) with predictable income that think the $69,000 annual contribution limit is too low, the defined benefit plan might be a good alternative. A defined benefit plan flips the traditional 401(k) upside-down. A traditional retirement plan gets funded, adds market performance, and results in an accumulated account balance. A defined benefit plan, on the other hand, assesses the desired ending account balance, accounts for market performance, and then determines what kind of contribution is needed to be successful. A defined benefit plan sets an account goal and works backwards.

For younger employees, the contributions will be relatively cheap since the employee has a long time to allow the market performance to accumulate to the desired ending balance. For older employees, the contributions can be extraordinarily high, up to $280,000. For businesses with high cash flow, an owner nearing retirement, and the desire for significant tax deductions, defined benefit retirement plans are a welcomed conversation. The goal of a defined benefit retirement plan is to accumulate a pre-calculated amount of money to provide “mailbox money,” or a sustained income flow in retirement. Because they can be complicated to manage, defined benefit plans are less commonly used, but when they fit, they are extremely effective.

Cash balance plans

Cash balance plans are a combination of defined benefit and defined contribution retirement plans. A cash balance plan is a retirement plan that calculates the funding like a defined benefit retirement plan, but the outcome of the account is variable like a defined contribution plan. Cash balance plans are useful if a defined benefit plan is desired, but the plan needs to be less strict than a traditional defined benefit retirement plan. Defined benefit plans can become onerous to manage, so if there comes a time when it makes sense to simplify a defined benefit plan, converting to a cash balance plan can be a relief. Cash balance plans are a great way to achieve large deductible retirement plan contributions without the administrative rigors of a traditional defined benefit plan.

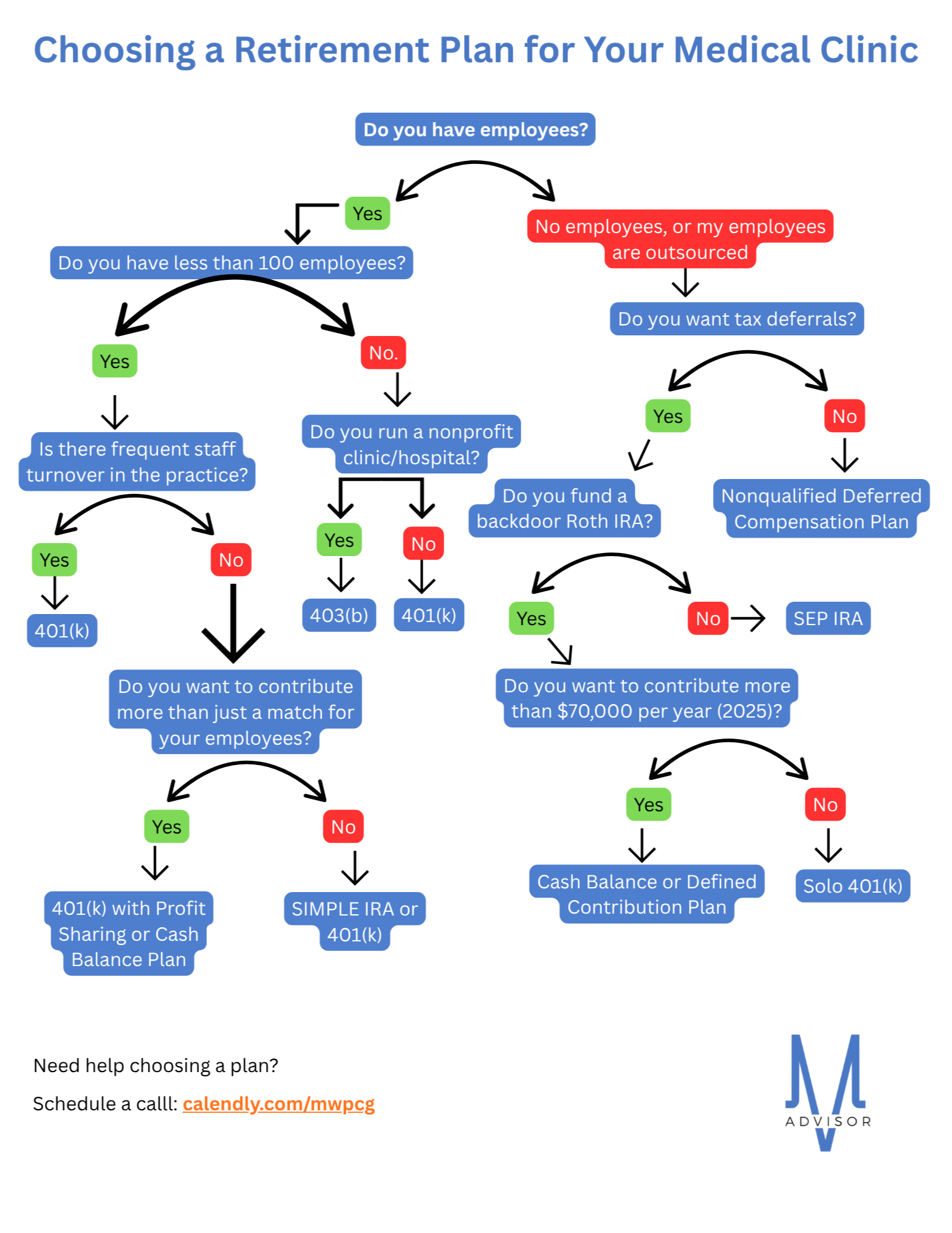

What will you choose?

Choosing a retirement plan for a medical clinic is an important task, and there is no shortage of options available. Physician businesses range from solo business owners to clinics with dozens of employees to multi-state mega hospital systems. What works for one medical practice does not always translate to another.

Paul Morton is a certified financial planner.

![AI censorship threatens the lifeline of caregiver support [PODCAST]](https://kevinmd.com/wp-content/uploads/Design-2-190x100.jpg)